Libby O’Brien Kingsley & Champion is pleased to announce that Tyler Smith has been appointed by the Maine Supreme Judicial Court to the Advisory Committee on the Maine Rules of Appellate Procedure. The Committee is comprised of 11 attorneys, and is tasked with reviewing the Maine Rules of Appellate Procedure, making recommendations to the Supreme Judicial… Read more »

Sean C. Rogers Joins The Firm As An Associate Attorney

Libby O’Brien Kingsley & Champion is very pleased to welcome Sean C. Rogers to the firm. Sean joins the firm as an associate and will be handling family law and civil litigation matters. Prior to joining the firm, Sean was an associate at a law firm in Kennebec County. The addition of Sean to our… Read more »

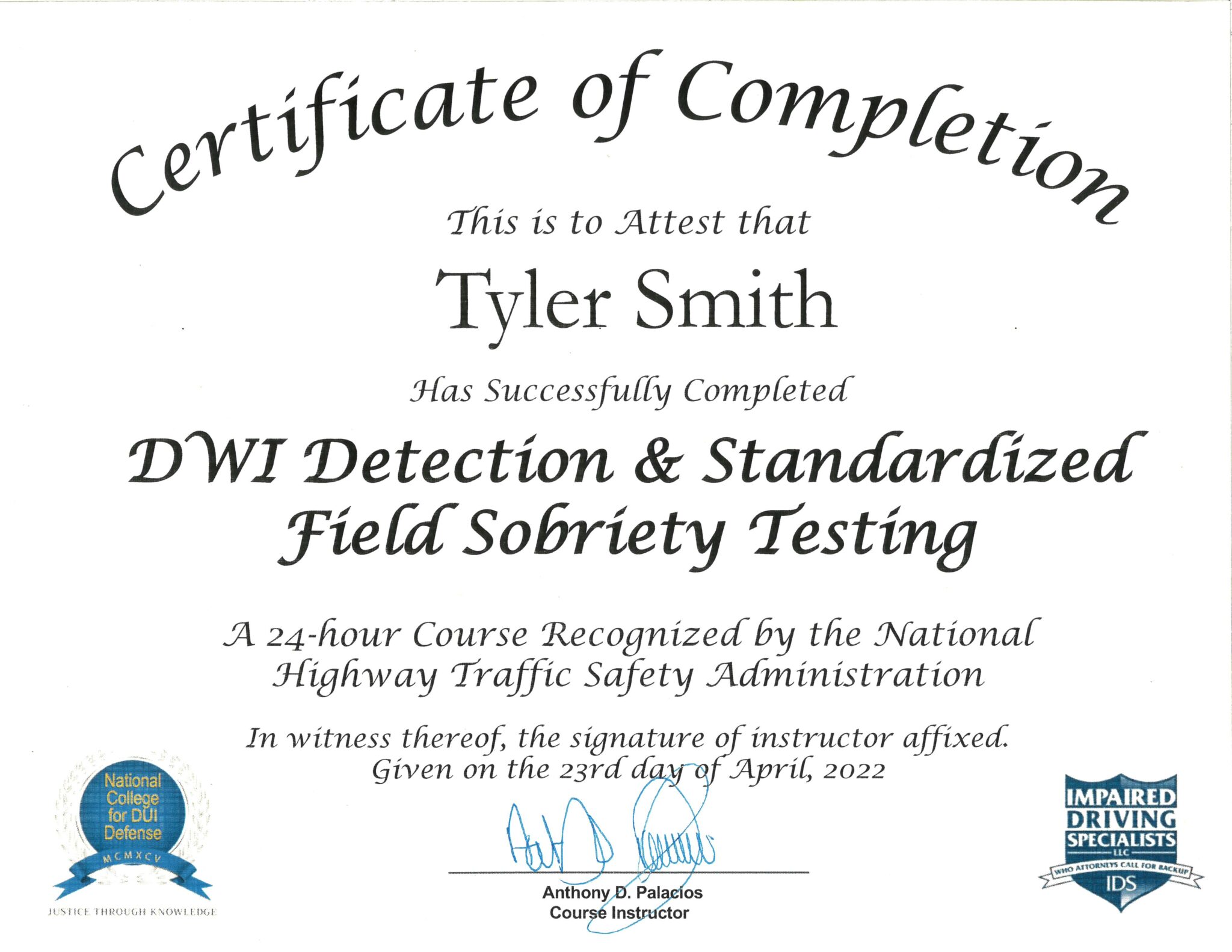

Tyler Smith Graduates NHTSA’s DWI Detection and Standardized Field Sobriety Testing Training

Tyler Smith just graduated NHTSA’s DWI Detection and Standardized Field Sobriety Testing (SFST) in Washington D.C. The 24-hour course is the exact training law enforcement officers receive on how to conduct drunk driving investigations. An experienced SFST instructor who has trained thousands of law enforcement officers taught the course. The course covered all three phases… Read more »

Dominic Parent Joins The Firm As An Associate Attorney

Libby O’Brien Kingsley & Champion is very pleased to welcome Dominic Parent to the firm. Dominic joins the firm as an associate and will be handling a variety of civil and criminal matters. Prior to joining the firm, Dominic was an associate at another York County law firm. The addition of Dominic to our firm… Read more »

Maine Bar Journal features article

Libby O’Brien Kingsley & Champion, LLC is proud to announce the publication of an article by Keith Richard in the Winter Edition of the Maine Bar Journal (Volume 36, No. 1, 2021). Keith’s article presents a detailed review and analysis of the Maine Supreme Judicial Court’s decision in Tomasino v. Town of Casco, 2020 ME 96, in… Read more »

John Sweeney is elected to second term as President of the Downeast Chapter ALA

John Sweeney was recently elected to serve a second consecutive term as President of the Downeast Chapter of the Association of Legal Administrators. As the Firm Administrator at Libby O’Brien Kingsley & Champion, John oversees the non-legal business functions of the firm, including finance, human resources, technology, day-to-day operations, and other general business management. The… Read more »

Keith Richard is recognized by the Katahdin Counsel for pro bono work

Keith Richard was recently recognized by the Maine Supreme Judicial Court’s Katahdin Counsel Program for his pro bono work for the third straight year. In a state with over 3,600 attorneys, Keith was one of only 107 Maine attorneys to achieve Katahdin Counsel recognition, which recognizes attorneys that contribution 50 or more hours of pro… Read more »

Tyler Smith presents at 19th Annual Employment Law Update

In September 2020, Tyler Smith presented at the Maine State Bar Association’s 19th Annual Employment Law Update. Tyler spoke on the topic of “Employment Law – Year in Review,” with a focus on state and federal case law. He and his co-presenter surveyed the year’s developments and discussed some of the highlights for Maine employment… Read more »

Tyler Smith defends right to travel at First Circuit Court of Appeals

Attorney Tyler Smith presented oral argument on September 9, 2020, to the First Circuit Court of Appeals, defending the constitutional right to travel against Governor Janet T. Mills’ 14-day quarantine order. The appeal was brought by a Maine campground whose business has been harmed by the quarantine, as well as several individuals. The oral argument… Read more »

Libby O’Brien Kingsley & Champion files brief challenging 14-day quarantine in Maine

Attorneys Gene Libby and Tyler Smith filed an opening brief (Principal Brief for Appellants) in the First Circuit Court of Appeals in a federal lawsuit challenging an executive order by Maine Governor Janet Mills requiring that all people arriving in the State of Maine quarantine for 14-days due to the COVID-19 outbreak. The lawsuit was… Read more »